- Your Government

-

Our Community

-

- About St. Helens History of St. HelensState of the CityCourthouse Dock Camera

- Local Events City Calendar Citizens Day in the ParkRecreation Activities Discover Columbia County Sand Island CampingKeep It Local CC

- Community Resources City Newsletter City Social Media Emergency Services New Resident InformationProtecting Our Environment

-

-

Business & Development

-

- Local Business Directory Get a Business License City Bids & RFPs Broadband Study

- Business in St. Helens St. Helens Advantages Directions & Transportation Incentives & Financing Resources for Businesses Business Guide Columbia Economic Team Chamber of Commerce

- Current City Projects Waterfront Redevelopment Public Safety Facility Strategic Work Plan

-

-

How Do I?

-

- Apply for a Job Apply for a Committee Find A Park Find COVID Info Find Forms Follow St. Helens - Facebook Follow St. Helens - Twitter Follow St. Helens - YouTube

- Get a Police Report Get a Business License Get a Library Card Get a Building Permit Newsletter Signup Past Public Meetings Pay My Water Bill

- Public Records Request Report a Nuisance Register for Rec Activity Reserve a Park Sign Up for the 911 Alerts Universal Fee Schedule

-

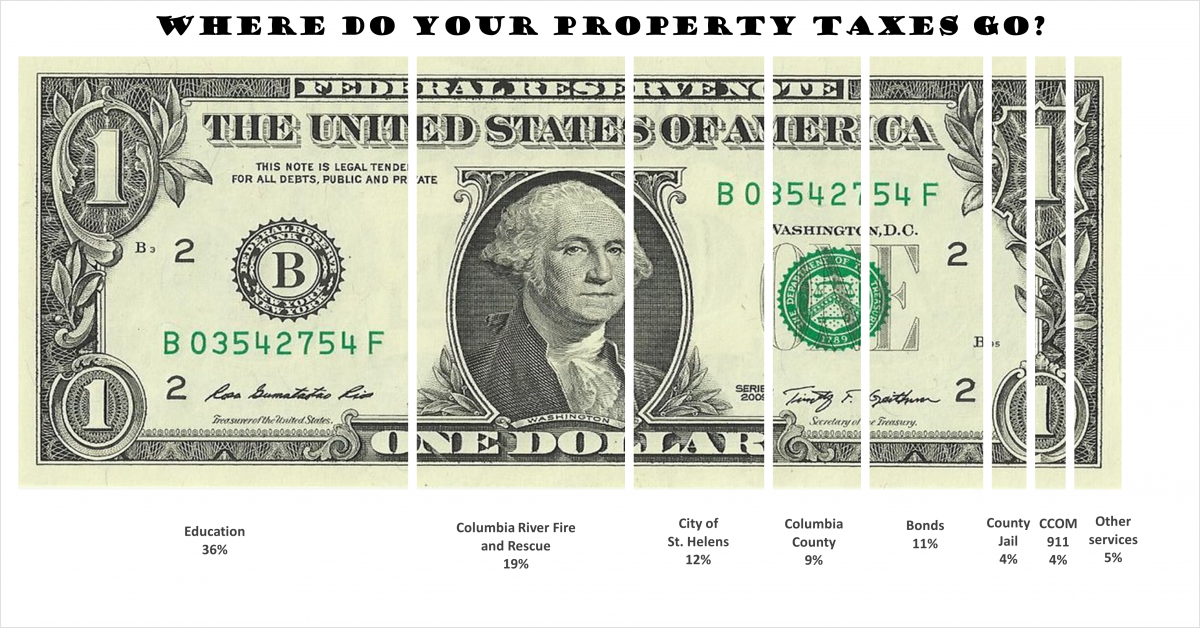

Where Do Your Property Taxes Go?

St. Helens has one of the lowest property tax rates in the county and the state, but where do the taxes go once they’re collected? How much does the City get? How much goes to schools?

Here’s a breakdown of what percentage of your money goes to what agencies based on a house valued around $400,000. An example of what the tax statement for this property might look like is available here or attached below.

The largest percentage of your property taxes — just over 35% — goes to education. That includes both our local St. Helens School District and Portland Community College. It also includes a small amount of funding for Northwest Regional Educational Service District, which provides additional services to our district.

19% goes to Columbia River Fire And Rescue to provide emergency services for Columbia County.

12% goes to the City of St. Helens and 9% goes to Columbia County to form part of their general funds.

11% goes to bonds, including the St. Helens High School Improvements Bond passed in 2016 and the Portland Community College Bond passed in 2017.

4% funds the Columbia County Jail operations and another 4% funds CCOM 9-1-1.

The final 5% is made up of several recipients that includes things like Columbia County OSU Extension Service and 4-H, the Soil and Water Conservation District, funding for the Eisenschmidt Pool, and the St. Helens Urban Renewal Agency.

To find out more about where your taxes go, view the document "Know Your Statement" attached below.